The FDIC OIG’s Report on Unimplemented Recommendations, provided below, contains information about recommendations from our audits, evaluations, and reviews that the OIG has not closed because our office has not determined that the FDIC has fully implemented recommended corrective actions.

The status of each recommendation is subject to change due to the FDIC’s ongoing efforts to implement them, and the OIG’s independent review of information about those efforts. Specifically, a recommendation identified as unimplemented in this report may fall into one of several categories:

- The FDIC has not completed the planned corrective action to address the recommendation,

- The FDIC has completed corrective action but has yet submitted the documentation to the OIG for review,

- The OIG is reviewing documentation submitted by the FDIC to assess whether the recommendation can be closed.

Further, the OIG may have subsequently closed a recommendation listed in this report after the date of its issuance.

For each Unimplemented Recommendation listed, we provide the report title, along with a link to the full report if available; the date of report issuance; and a brief description of the recommendation.

Our Unimplemented Recommendations listing will be updated monthly.

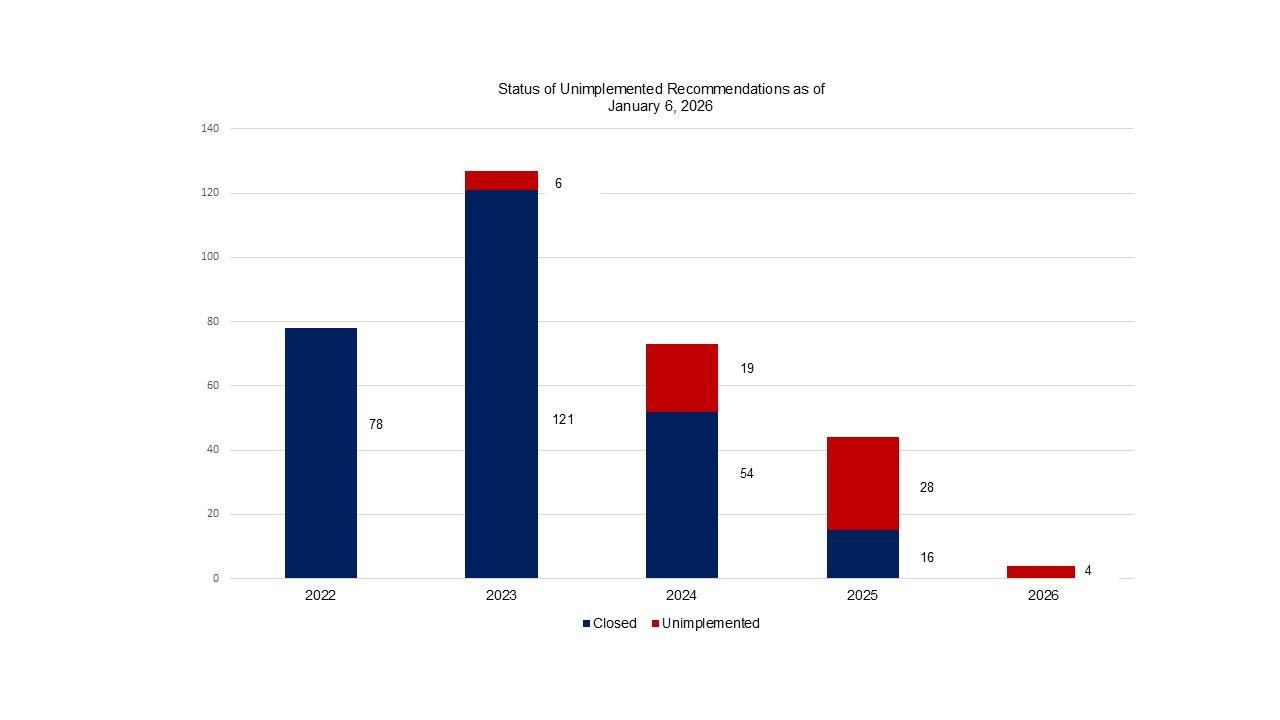

Status of Unimplemented Recommendations as of January 6, 2026

Unresolved Recommendations

Unimplemented Recommendations

The FDIC’s Student Residence Center

Develop and finalize processes and procedures for real property asset management-related activities, to include acquisition, management, utilization, and disposal of owned real property.

Establish and execute a data-driven decision-making process for the current and future use of the Student Residence Center and its operations. At a minimum, this process should:

a.

Identify and centralize sources of Student Residence Center-related financial and non-financial data across the FDIC, as appropriate.

b.

Utilize and analyze financial and non-financial data identified to inform Student Residence Center resource allocation decisions to achieve the best value.

Develop performance goals and objectives for the Student Residence Center, in alignment with the FDIC’s mission, strategic plan, and performance goals.

Leverage FDIC Directive 4010.03, Enterprise Risk Management and Internal Control Program to identify, assess, and manage risks specifically related to achieving the Student Residence Center performance goals and objectives, and coordinate with the Office of Risk Management and Internal Controls, as necessary.

The FDIC’s Information Security Program – 2025

Ensure privileged user access reviews for the [redacted] system are performed in accordance with FDIC policy.

Define the accounts, permissions, and roles that are considered privileged within [redacted].

Ensure privileged user access reviews for [redacted] are performed in accordance with FDIC policy.

Ensure a complete and accurate user listing is utilized for the [redacted] user access review as required by FDIC policy.

Audit of Security Controls for a Cloud Platform and Application

We recommend the Director, Division of Information Technology [redacted].

We recommend the Director, Division of Information Technology, limit user access by following the least privilege access principle where appropriate to documents on the cloud service provider [redacted].

We recommend the Director, Division of Information Technology, in coordination with the Director, Division of Depositor and Consumer Protection,[redacted].

We recommend the Director, Division of Information Technology, identify and review the continued need for other [redacted] that provide similar capabilities to launch [redacted].

We recommend the Director, Division of Information Technology coordinate with the vendor to mitigate the impact of [redacted].

We recommend the Director, Division of Information Technology, coordinate with the vendor to fix the [redacted].

We recommend the Director, Division of Information Technology, coordinate with the vendor to re-examine the need to [redacted].

We recommend the Director, Division of Information Technology, coordinate with the vendor to [redacted].

Significant Service Provider Examination Program

Complete efforts to develop and implement program-level goals and metrics for both the Regional and Significant Service Provider Examination Programs. This should include finalizing and implementing the Inherent Risk Methodology Analysis.

The FDIC’s Procurement of Resolution and Receivership Services

Review existing financial advisory and consulting services Receivership Basic Ordering Agreements and take appropriate steps to establish an adequate supply of contractors with appropriate resources to address the FDIC’s future procurement needs in the event of financial institution failures and financial crises.

Establish a process to periodically review financial advisory and consulting services Receivership Basic Ordering Agreements to ensure sufficient contractor resources are available to meet the FDIC’s mission-critical needs.

Establish an upfront pricing framework or advanced pricing within all financial advisory and consulting service Receivership Basic Ordering Agreements.

Develop and implement periodic emergency procurement testing exercises for appropriate FDIC employees.

Establish a process for emergency procurements to document and maintain analysis, decisions, and commitments, to include, at a minimum, those identified in this report.

Develop and implement a process to analyze and determine when documented deliverables should be required on emergency service contracts to ensure contract personnel have the ability and resources to oversee contractor performance.

Perform retrospective reviews when the FDIC conducts or tests emergency acquisition procedures.

Review the work performed and information used by the four non-U.S. citizens and take appropriate action.

Provide training and guidance to its Executive Management and personnel reinforcing their roles and responsibilities in carrying out and overseeing the FDIC’s emergency acquisition procedures. This training and guidance should include, at a minimum, the following:

• understanding roles and responsibilities;

• initiating and performing emergency and expedited procedures; and

• initiating, modifying, approving, and submitting requirements packages.

Special Inquiry of the FDIC’s Workplace Culture with Respect to Harassment and Related Misconduct – Part 1

The Chairman and FDIC Board of Directors set a tone at the top where all FDIC executives model the FDIC’s core values and principles through their behaviors and attitudes. This should be assessed and measured regularly by climate surveys with appropriate actions taken.

FDIC Readiness to Resolve Large Regional Banks

Establish and implement an agency-wide resource committee to monitor and report on corporate resource needs, including existing recruiting strategies, staffing levels, and information technology resources in order to strengthen resource planning and response capabilities for large regional bank resolutions.

Establish a practice of regular interdivisional participation in the development and review of the Regional Resolution Framework procedural documents, as appropriate.

Develop and implement a resolution readiness training program for key personnel responsible for executing the Regional Resolution Framework and related procedures. The training program should address awareness, plan-specific, role-based, and functional training.

Establish and implement a process of periodic interdivisional exercises of large regional bank resolution activities, to test the ongoing effectiveness of agency-wide response and coordination.

Identify from after-action review documents the recommendations that are the most critical for large regional bank resolutions and prioritize them with formal tracking and monitoring.

The FDIC's Information Security Program - 2024

Enforce existing policies and procedures to consistently perform reviews and analyze system audit records, and document and maintain those reviews and analysis for privileged users and actions taken on [redacted] devices in accordance with FDIC policy.

Conflicts of Interest in the Acquisition Process

Develop a means of identifying and documenting acquisition-specific team members from the Program Offices, Division of Administration Acquisition Services Branch, Legal Division, and Office of Minority and Women Inclusion.

Update the Acquisition Procedures and Guidance Manual to (1) define “reasonable planning,” (2) require the documentation of “reasonable planning” for all acquisitions, and (3) require a written description of potential or actual acquisition-specific conflict of interest-related risks in planning documentation.

Develop procedures requiring acquisition team members, as defined in response to Recommendation 1, to complete a conflict of interest certification in which each team member is to assess and document that they do not have a potential or actual conflict of interest related to the specific acquisition prior to participating in any phase of the acquisition lifecycle (from planning to closeout). These procedures should require that evidence of acquisition team members’ conflict of interest certifications is maintained in accordance with requisite FDIC records retention schedule requirements.

Develop procedures requiring acquisition team members, as defined in response to Recommendation 1, to re-certify annually that they remain free of actual or potential conflicts of interest as long as the acquisition is in place.

Audit of Security Controls for the FDIC's Cloud Computing Environment

Remediate the 7 findings and 19 associated recommendations identified in Cloud Platform #1 and the applications built on Cloud Platform #1

Remediate the 8 findings and 11 associated recommendations identified in Cloud Platform #2 and the applications built on Cloud Platform #2

Remediate the 4 findings and 7 associated recommendations identified in Cloud Platform #5.

This recommendation is redacted.

Design and implement a plan to prevent, detect, and remediate security weaknesses on FDIC cloud platforms and applications related to insecure coding practices, misconfigured security settings, least privilege violations, outdated software versions, and ineffective monitoring.

The FDIC’s Sexual Harassment Prevention Program

We recommend that the Chairman: (a) incorporate a specific harassment-free culture standard into the Performance Management Program and Bonus Criteria for all staff; (b) incorporate harassment prevention into the bonus criteria for managers and executives; (c) develop and implement a process that considers violations of the anti-harassment policy when determining whether an employee should serve in a supervisory or managerial capacity; and (d) develop and implement a process that considers violations of the anti-harassment policy when determining whether an employee is eligible to receive a bonus.

We recommend that the Chairman/COO develop and implement a mechanism to ensure that corrective actions used to close recommendations related to the sexual harassment prevention program are sustained.

We recommend the Director, Division of Administration, conduct a review of prior allegations to ensure that it has an accurate and complete population of sexual harassment allegations and that it has maintained all allegation records in accordance with the FDIC record retention schedule, which requires that all records be maintained for 7 years.

We recommend the Chairman consider developing and implementing Agency-wide, consistent penalties or recommended penalty ranges to be used in disciplinary actions for harassing conduct, in accordance with applicable laws and regulations, and, as necessary and appropriate, incorporate the consistent penalties and recommended penalty ranges into policy and procedures.

We recommend that the Chairman develop and implement a plan to routinely analyze the FDIC’s sexual harassment training, ensure that it is current, and measure the impact that training is having on reducing harassment and retaliation in the Agency.

Review of the FDIC’s Ransomware Readiness

Evaluate and consider enhanced solutions to store backup data, as described in the report, and update the Storage Systems Backup Data Protection Standard Operating Procedures, as appropriate.

Conduct an analysis to identify viable alternatives for testing restoration of Active Directory from backups, or have senior management formally accept the risk of not testing these backups.

Material Loss Review of Signature Bank of New York

Reevaluate the FDIC's strategy to attract, retain, and allocate staffing, including how to enhance the supervision of large, complex financial institutions.

a. This evaluation should be documented and submitted to the FDIC’s Chairman for review and approval.

Implement target metrics and monitor variances for key supervisory outputs consistent with requirements contained in CEP Procedures, such as:

a. Supervisory Plan percentage completed to actual percentage completed to identify and take timely corrective action when examination teams are not on

track to achieve objectives detailed in annual supervisory plans.

b. Target review start date to actual review start date to identify and take timely corrective action when examination teams are not on track to achieve objectives

detailed in annual supervisory plans.

c. Number of days elapsed between target review start date and exit meeting to expectation to identify and take corrective action when reviews are not being completed and informal results communicated to the bank timely.

d. Number of days elapsed between target review start date and issuance of Supervisory Letter to expectation to identify and take corrective action when the results of reviews are not being completed and results communicated to the bank timely.

e. Number of days elapsed between year-end and ROE issuance to expectation to identify and take corrective action when ROEs are not being completed and

results communicated to the bank timely.

f. Number of days elapsed between quarter-end and issuance of Ongoing Monitoring Reports to expectations to identify and take corrective action when

ongoing monitoring is not being completed timely.

The FDIC’s Orderly Liquidation Authority

Develop and consistently maintain comprehensive Orderly Liquidation Authority policies and procedures for systemically important financial companies, to include:

a. Tier I policies and procedures for framework-level activities.

b. Tier II policies and procedures for operational process-level activities.

c. Tier III policies and procedures for institution-specific planning activities.

d. Other operational program policies and procedures for Orderly Liquidation Authority resolution planning activities.

Apply Tier III policies and procedures to develop and consistently maintain institution-specific resolution planning documents for all nonbank financial companies and financial market utilities designated by the Financial Stability Oversight Council as systemically important.

Conduct and document a representative survey or other assessment of the Orderly Liquidation Authority-related skill sets existing or needed within the Division of Complex Institution Supervision and Resolution and ensure the Division’s Professional Development Plan incorporates the results.

Regularly conduct and document Orderly Liquidation Authority general and functional training and ensure that training is clearly linked to the key components of the systemic resolution framework and processes.

The Federal Deposit Insurance Corporation's Information Security Program - 2023

Implement process improvements to ensure prompt notification and removal of user network accounts on or before the user’s separation date.

Sharing of Threat and Vulnerability Information with Financial Institutions

Ensure that all data sets within the FDIC that contain relevant threat and vulnerability information are assessed and natural language processing or alternative technological capabilities are considered for enhancing threat and vulnerability information sharing operations.